Over the past several years e-Commerce powerhouses like Square, Shopify and others have quietly made a diversification move that’s been a game changer for their business model and bottom line.

Today FunnelDash is making it easy for agencies to do the same with a white label Capital Division service that allows you to offer financing options to your clients that can increase profits, elevate your brand, and improve client retention -- with very little effort on your part.Want proof it’s a smart move?

Square began by offering cash advances. In 2015 they issued $400 million to their merchants who used the cash to invest in long-term upgrades that Square figured could help the company generate more revenue in the future. And it was working really, really well. At the time, Square Capital was one of the company's fastest-growing product segments.

Still, in its 2015 S-1 filing, the company reported that it was not yet profitable. To make the leap into the black, Square decided to try diversifying the company’s offerings beyond its mobile point-of-sale product to boost revenue.

Offering loans was the next logical step.

According to a Business Insider Intelligence “Payment Industry Insider” analysis, the company made the move to adding long term loans to their already thriving advance offerings to amplify that growth and earrings by allowing the company to earn fee revenue.

Square projected that the company could successfully attract borrowers because its loans would charge interest rates that were competitive with, and in some cases lower than, APRs charged on business credit cards.

In addition, offering loans would help Square become more competitive with other online lenders and elevate its brand by providing personalized lending as part of a full service suite.

For a payment company like Square, offering loans and advances was a way to develop a new revenue stream and help their small business clients grow and generate more money from credit card transaction fees.

The gamble to offer loans as part of Square Capital paid off. Big time.

Recently, the investment firm The Motley Fool identified Square stock as 2020's Best Profit Opportunity making this assessment:

Square's growth story in the fintech world has certainly been an impressive one, but I'd make the argument that we could still be seeing just the tip of the iceberg. Just to name some of the biggest potential catalysts, here's why I think Square could ultimately grow to many times its current size.

*****

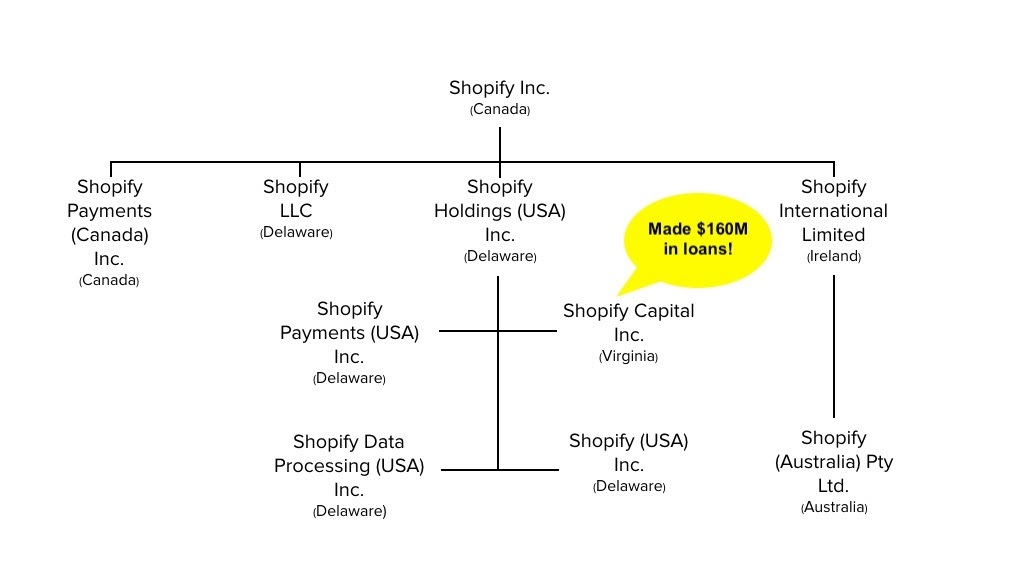

Shopify has a similar success story.

In 2016, the e-Commerce company rolled out Shopify Capital to extend loans to US merchants. By December 2019, Shopify had extended about $160 million in loans and advances to merchants. It recently expanded its highly successful program to Canadian small and medium sized businesses affected by the pandemic.

More recently, Shopify expanded its Shopify Capital services further to include micro-loans as small as $200 to new e-commerce entrepreneurs who agree to use the online selling platform provider’s Shopify Payments services.

The result is that Shopify is now the second largest company in Canada by market capitalization with a value of over CA$100 billion. It’s bigger than all the Canadian banks but the Royal Bank of Canada and looks like it will soon overtake them. Competitively, the company is also way ahead of most other e-Commerce companies with more than twice the market cap of eBay and a whole lot larger than Farfetch and Etsy.

The Challenges of Growing Agency Revenue Get Bigger Every Day.

Whether you’re a $50M agency or a $1B agency, everyone is looking for ways to get bigger, better, and more profitable. The first lever most owners reach for to accomplish that goal is ramping up new business efforts.

Running ads for more clients = more revenue, right?

The problem is that generating leads and converting them to clients is expensive, time consuming, and tough. Your mileage may vary but our experience here at FunnelDash says that you’ll only convert one out of every 30 new business leads you pursue.

And if you’re fortunate enough to land more than a few, there’s the problem of scale. You might need to hire more people which will significantly eat into your newly won profits. (Labor costs, can account for as much as 70% of total business costs.)

On top of that, there’s the challenge of client churn.

In an industry where clients are always being approached by the next hot agency promising higher ROI, it’s become increasingly difficult to hang onto new clients for any length of time.

Considering the current and future challenges of the online advertising industry and the financial success of Square and other online companies have achieved by starting their own Capital Divisions, now is the perfect time to consider following their lead.

The Advantages of Starting Your Own Capital Division Are Even Greater Than You Might Think

Companies often form separate business divisions as a way to develop a competitive market advantage. Becoming a FunnelDash Ad Capital Partner by adding a division that complements their core offerings is a relatively easy way to expand without significantly changing the company’s existing corporate structure.

Teaming up with FunnelDash to start a capital division at your agency to fund client ad spend would be a natural outgrowth of what you’re doing now -- and would very much work in your favor on a lot of different levels, because it will allow you to...

DOUBLE your client value. Right now your clients are likely always scrambling for money to fund their ads. They are spending less than they want to -- and really should -- because their cash flow is pinched.

By offering funding -- on very favorable terms -- you can help them ease that cash flow pinch so they’ll feel more comfortable upping their ad spend thanks funding that gives them;

60-day float on $10,000 a month or more ad spend

An extra 3-6 months for them to make their money back

The ability to grow faster without the need for expensive business loans, cash advances or lines of credit.

Easier access to cash for ad spend for them adds up to higher billings for you.

Increase client retention. Serving as a source of ongoing ad spend funding deepens your relationship with your clients. They’ll start to see you less as an ad-buying vendor and more as a partner in achieving their growth goals.

Position yourself as a premium agency. Agencies who simply manage Facebook advertising are a dime a dozen. Offering funding through your own branded capital division elevates your brand and sets you apart from the competition.

Attract and convert high value leads. Being known as an agency who has the horses to provide favorable financing for ad spends of $10k a month or more will mean you can spend less time chasing leads (they’ll seek you out) and more time closing them.

Generate $2k to $10k a month from our revenue share program. Being able to generate thousands of dollars a month in “passive revenue” is perhaps the most compelling reason of all to start your own capital division.We basically do all the heavy lifting for you. Simply add the snipppet to your website menu and start offering what every client wants and needs (cash flow for ad spend) and few if any of your competitors are offering.

There’s no need to hire more people, train your staff, or set up a back-office to handle underwriting, origination, servicing, collections or reporting and compliance. Plus you’ll be assigned your own dedicated Ad Funding Advisor who will work with each of your clients to get them the capital they need to scale. You just sit back and watch your revenues start climbing.There’s never been a better time to follow the money to a more lucrative business model that more and more online companies are gravitating to than now. Find out more about becoming a

FunnelDash Ad Capital Partner