Increasingly, ecommerce isn’t just big business, it’s THE business to be in.

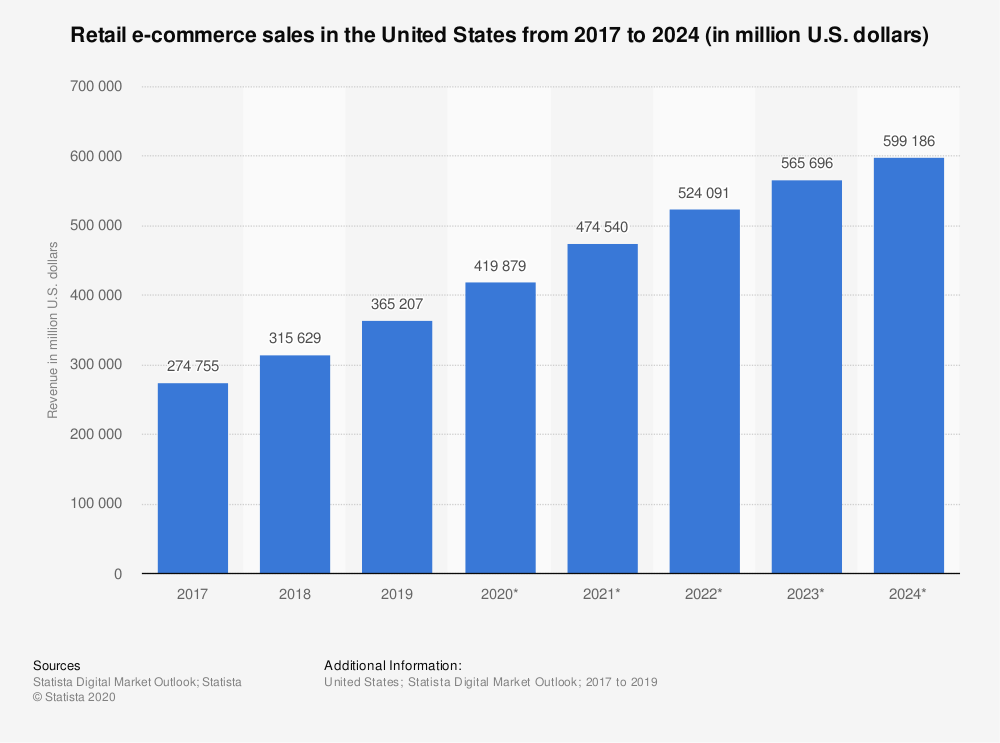

While the $25 trillion USD global retail market’s growth significantly slowed in 2019 compared to the past five years, worldwide ecommerce sales have increased by 18% to $3.5 trillion USD from the year before. And it’s projected to nearly double to more than $6.5 trillion USD by 2023.

Part of what’s driving growth is the generational shift of digital native Generation Z entering the workforce with dollars they feel more comfortable spending online than earlier generations. At the same time, Millennials will continue to progress in their careers and have more disposable income to buy things online.

That coupled with emerging ecommerce markets in Latin America, the Middle East, Africa, and Asia as the countries become more developed and the population has more money to spend, all points to a world where millions more customers want to buy millions of more things online.

That’s great news for online retailers like you.

But before you start doing the Snoopy dance, you need to understand how well your ecommerce business is actually doing

To do that, you’re going to have to have a pretty good grasp of your stats and know how to interpret them.

There is no end of ecommerce statistics out there, but in general here are the ones I track to determine when you break even on the Cost of Customer Acquisition.

Conversion Rate

The rate at which visitors who come to your site become customers. If 2 out of every 4 visitors who come to your site buy something, your Conversion Rate is 50%.

So, what’s a good conversion rate?

For ecommerce, generally unless you’re selling a really high-ticket item, if you’re converting below 1% you’re hemorrhaging money. Anything between 1% and 1.5% is pretty sustainable. Over 1.5% is epic. Over 2% and you’re gold.

Just for some perspective, WordStream’s new Shopping Benchmarks report which they describe as a “deep dive” into how ecommerce businesses from 16 different verticals are performing on Google Shopping and Bing Shopping, says:

Across all verticals, the average Google Shopping conversion rate is 1.91% and the average Bing Shopping conversion rate is 1.74%.

While Google shoppers convert at a higher rate, they cost more to acquire. The average Google Shopping CAC is $38.87, the average Bing Shopping CAC is only $23.05.

Ecommerce businesses in the Office & Business Needs vertical are killing it on Bing Shopping: they convert clicks into actions at an average rate of 15.19%.

Average Order Value (AOV)

The average dollar amount customers are spending on day one. If you have 10 customers who all together spend a total of $500 on day one, your AOV is $50. Over time, the cost of acquiring a customer (CAC) is going to go up, so you’ll want to take steps to increase the AOV post-funnel by offing order bumps, upsells, and deals on advance purchasing future months of a subscription which also helps reduce churn.

Customer Acquisition Cost (CAC)

The TOTAL cost of acquiring a customer, not just the cost of the ad spend. You need to factor in office overhead, margins (cost of goods), salaries, expense of creating and placing the ads – everything. With tracking conversions and CAC, it's important to note blended acquisition costs specifically paid versus organic. It's important to know how you're converting from a paid perspective so you're not buying customers over LTV or too far over your Payback Period.

Margins

The cost of goods (COG) for your product – whether that’s purchasing it wholesale or manufacturing it yourself. Be sure to factor in things like shipping costs, labor, raw materials etc.

Payback Period

The time it takes from when you first place an ad to the point at which the customer has spent enough with you to cover the total CAC. For average ecommerce businesses that time period typically is between 30 and 60 days – during which time you are actually losing money. (More about that later).

Lifetime Value (LTV)

The total amount of money the average customer will spend on your product before they stop purchasing from you. If the average subscriber to a $25 a month product or service stays with you for 24 months, their lifetime value is $600.

Churn

The amount of time customers continue purchasing your product. This is particularly relevant for subscription-based products and services. If 8 out of 10 customers cancel their subscription after a certain period of time (say 6 months), you have an 80% churn rate. Your bucket is likely leaking more customers faster than you can replace them.

The difference between success and failure.

So, let’s get back to the central premise of this post – how to use these statistics to know whether your ecommerce business is cranking or tanking. And if it’s the latter, how to get it back on track.

It all comes down to cash flow.

How much money is going OUT in terms of CAC, Margins, and Churn versus how much money is coming IN in terms of AOR and LTV – and how long it takes to recoup the costs and start turning a profit.

his is where the trap of the Payback Period really comes into play.

If you’re a company that sells a subscription product your Payback Period might be between 30 and 60 days. If you’re a company with a product affected by seasonality – typically items people buy as gifts for the holidays – you’re probably sucking wind Q1 through mid Q3 when things start to ramp up.

The point is from the time you place the ads to when they start turning a profit, you are financially dead in the water. And that’s a recipe for disaster.

Making sure you have a constant and growing cash influx should be your goal. The shorter your payback period is, the more efficient your acquisition methods are, and the sooner you’ll be able to start reinvesting that money into your company.

The trick is finding a way to get funding to bridge that gap so you can keep buying ads and keep the lights on at your company. So, what are your options?

Payback Period Float Funding

One of the best, easiest -- and least utilized way -- to slash months off your payback period is to negotiate a net 60-day deal. If you’re working with an agency to purchase ads, negotiate a net 60 payment agreement instead of 15 or 30 days. That way, they pay for the 2-month float that can ease your cash flow until the ads start paying out. But agencies aren’t the only vendors you can get a net 60-day float period with.

FundMyAds

FundMyAds is a growth capital option specifically created to solve the ad spend/payback period problem that every online advertiser faces by giving you fast, easy interest-free access to $30,000 to $1M for one small flat fee.

Think of it as a bridge loan -- the kind I mentioned earlier -- that will pay for ads during your payback period so you can keep the orders rolling in With FundMyAds your ecommerce firm can look forward to getting the money you need with…

No VC equity dilution or loss of control

No high interest rates -- our low-interest funding rates go all the way down to 0%

Flexible payment plans

No personal guarantees

Expert marketing and Facebook ad campaign support

And receiving your funding in as little as 24 hours

What are you waiting for? Apply today.

Chances are, right now your Payback Period is eating your cash flow alive. Why not take advantage of an option that front the money for online ads that will bring in a steady flow of new orders – and give you the time you need to pay it back interest-free?