The days when advertising your accounting, engineering, architectural firm or other professional services simply meant placing an ad in your local paper or lifestyle magazine are long gone.

More...

According to its U.S. Local Advertising Forecast 2019 survey conducted by BIA Advisory Services, the professional service industries were projected to spend close to half their ad budget on digital totaling $2.5 Billion in 2019.

With 79% of American Internet users being on Facebook which provides an extremely cost-effective way to run ads targeted to a specific audience in your area, there’s every good reason in the book to spend a big chunk of your ad budget on the platform.

Here are just a few good reasons to advertise your firm on Facebook.

- Increase your website traffic. Research shows that people spend at least 30 minutes a day on Facebook. The chances of a potential client seeing your ad and clicking through to your website is exponentially greater than them Googling your services and then choosing your firm from a long list of search results to find out more. This added visibility will generate increased website traffic, Facebook Business page views, and attract more clients to your firm.

- Target your best prospects. You probably know what your most likely potential clients “look” like in terms of where they live, how old they are and what they do for a living. In order to make sure your ad spend is as cost effective as possible, you can target your Facebook ad to a specific geographic location, age group, job title, or any other relevant interests your prospects might have.

- Measure the success of your ad campaigns. With the combination of metrics available from both your accounting website and Facebook Ads campaigns, you'll get a detailed understanding of how well your efforts are performing and overall return on investment.

The secret to a successful online ad campaign is understanding your stats.

There are no end of online advertising statistics out there, but in general here are the ones that you need to know to determine the key metric of when you break even on the Cost of Customer Acquisition.

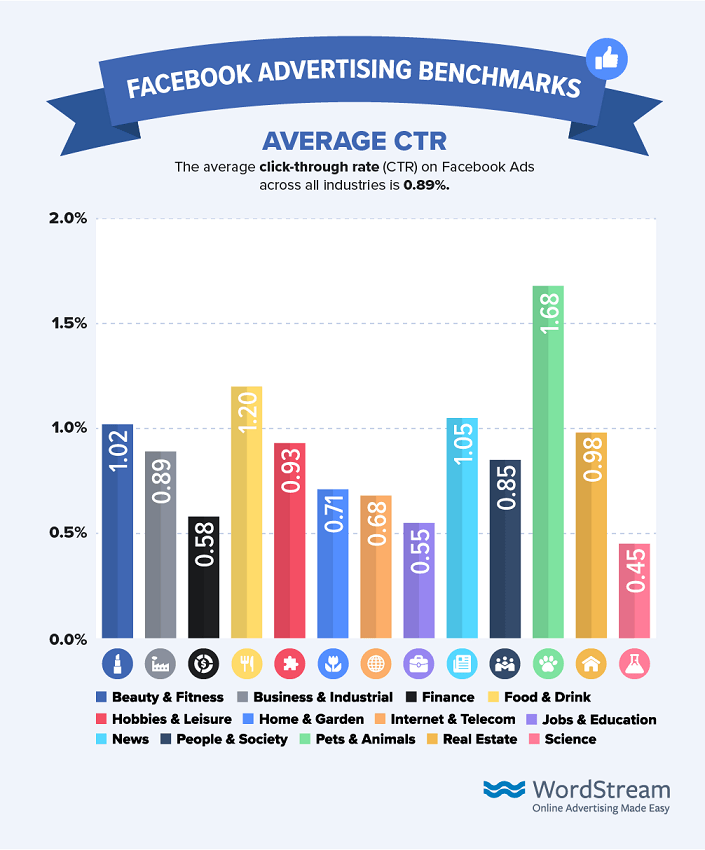

Conversion Rate

This is the rate at which visitors who come to your site become clients. If 2 out of every 4 visitors who come to your site buy something, your Conversion Rate is 50%. That would be pretty awesome since, according to WordStream’s Facebook Ad Benchmarks by industry, the average conversion rate (CVR) on Facebook Ads is 9.11% across all industries. The average for Business and Industrial firms is slightly better at 10.65%. That means for every hundred ads you place you’re likely to acquire about 10 customers.

That’s how Facebook advertising can make your professional services business.

Now let’s get into the financially scary part of Facebook advertising. Because getting those customers costs you something -- and it’s probably more than you think. So let’s look at a few other stats.

Average Order Value (AOV)

The average dollar amount customers are spending on day one. Chances are if you are an accounting, engineering, or other professional services firm, you don’t make money on day one. In fact you may not be making any money for 2 to 4 months after you acquire them. But say the revenue from those 10 customers you acquire adds up to $50,000, your AOV is $5,000.

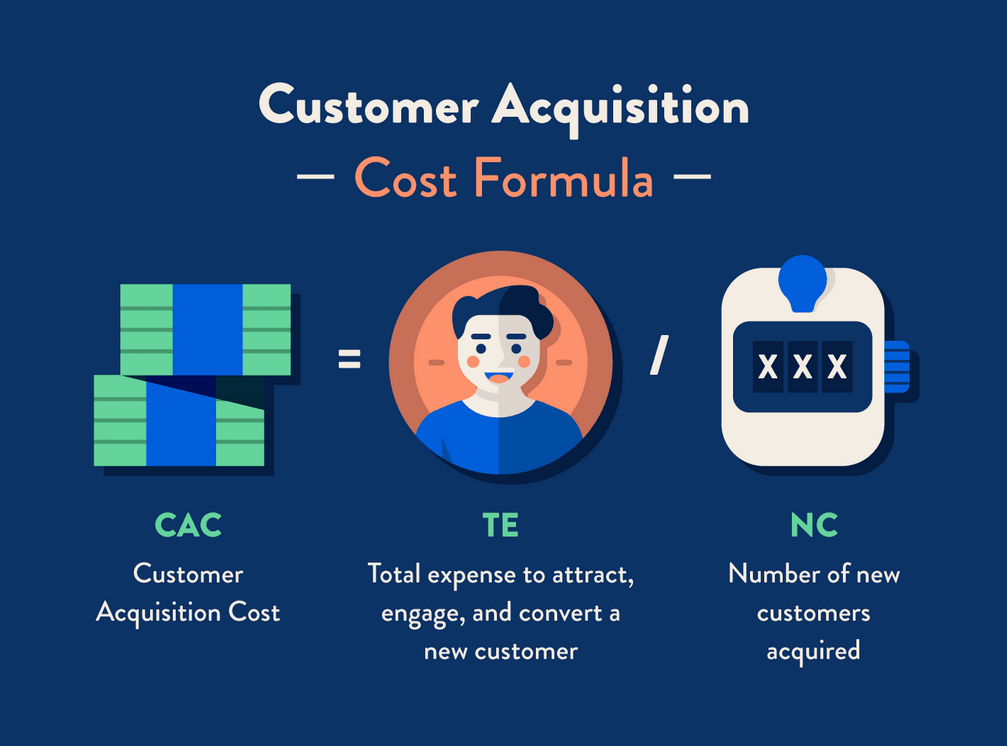

Customer Acquisition Cost (CAC)

The TOTAL cost of acquiring a customer, not just the cost of the ad spend. You need to factor in office overhead, margins (cost of goods), salaries, expense of creating and placing the ads – everything.

Payback Period

This is the time it takes from when you first place an ad to the point at which the new client has spent enough with you to cover the total CAC. As mentioned above, for average professional service businesses that time period typically is between 2 and 4 months – during which time you are actually losing money. (More about that later).

Lifetime Value (LTV)

The total amount of money the average customer will spend on your services before they stop working with you. If you have an accounting business where clients continue to use your services for years -- and even decades -- that can add up to tens if not hundreds of thousands of dollars. For one-off project based businesses, the LTV

may be limited to a single payment, which could be substantial. But say you have an ongoing business where you might charge a client $2,000 to do their yearly taxes and typically keep a client for 10 years, their LTV would be $20,000.

Churn

This is the amount of time customers continue purchasing your product. This is particularly relevant for ongoing professional services. If 8 out of 10 customers stop working with you after a certain period of time (say 2 years), you have an 80% churn rate. Which means you're losing clients faster than you can replace them.

Here’s how Facebook advertising can break your business.

So, let’s get back to the central premise of this post – how to take advantage of the business building power of Facebook advertising while avoiding the potential pitfalls of funding your ad spend.

For that we’ll use the above statistics to find out whether your ad spend is financially helping or hurting you. And if it’s the latter, how to get it back on track.

It all comes down to cash flow.

How much money is going OUT in terms of CAC, and Churn versus how much money is coming IN in terms of AOR and LTV – and how long it takes to recoup the costs and start turning a profit.

This is where the trap of the Payback Period really comes into play.

If you’re a firm that provides ongoing services your Payback Period might be between 2 and 4 months. So from the time you place the ads to when they start turning a profit, you are financially dead in the water. And that’s a recipe for disaster.

Making sure you have a constant and growing cash influx should be your goal. The shorter your payback period is, the more efficient your acquisition methods are, and the sooner you’ll be able to start reinvesting that money into your company.

The trick is finding a way to get funding to bridge that gap so you can keep buying ads and keep the lights on at your company. So, what are your options?

Here’s how to make it before you break it.

It basically comes down to the concept of asset/liability management which is managing assets and cash flows to pay for your ad spend and satisfy your other obligations. It’s a strategic and tactical way to manage the risk of spending money on ads faster than you can make it back.

There are various tactical things you can do to effectively increase your assets by getting funding from outside sources.

If your business is going gangbusters you might be able to attract Venture Capital Funding that could potentially pour millions of no-obligation-to-repay dollars into your ad spend -- but might require you to give up a stake in and possibly a measure of control over your company.

Unlike internet startups who can have a huge upside for future growth, most professional services firms aren’t candidates for venture capital, so you’ll need to look at other options. Some of these might include Working Capital Funding, Bank Loans or even Credit Cards that can provide a cash infusion but typically at high interest rates and personal guarantees that can put your home at risk if you default.

Fortunately there are a couple of much better options -- one you may have never heard about.

Payback Float Funding is one of the best, easiest -- and least utilized way -- to slash months off your payback period is to negotiate a net 60-day deal. If you’re working with an agency to purchase ads, negotiate a net 60 payment agreement instead of 15 or 30 days. That way, they pay for the 2-month float that can ease your cash flow until the ads start paying out. But agencies aren’t the only vendors you can get a net 60-day float period with.

solve the ad spend/payback period problem that every online advertiser faces by

giving you fast, easy interest-free access to $30,000 to $1M for one small flat fee.

Think of it as a bridge loan -- the kind I mentioned earlier -- that will pay for ads during your payback period so you can keep the orders rolling in. With FundMyAds your ecommerce firm can look forward to getting the money you need with…

No high interest rates -- our low-interest funding rates go all the way down to 0%

Flexible payment plans

No personal guarantees

Expert marketing and Facebook ad campaign support

And receiving your funding in as little as 24 hours

What are you waiting for? Apply today.

Chances are, right now your Payback Period is eating your cash flow alive. Why not take advantage of an option that front the money for online ads that will bring in a steady flow of new clients – and give you the time you need to pay it back interest-free?